Imagine if you could earn every single day through day trading without using your own capital? But as easy as it sounds, it comes along with hard works and disciplines.

Prop Firm??

If you’ve been scrolling through trading Twitter, watching finance YouTube, or hanging out in Discord trading groups, you’ve probably heard about prop firms—especially FTMO. But what exactly is a prop firm, and why is everyone talking about it? More importantly, can it help you make money as a day trader? Let’s break it all down in a casual, no-jargon way.

What’s a Prop Firm Anyway?

A proprietary trading firm (aka prop firm) is basically a company that gives traders access to their capital so they can trade with more money than they personally have. Instead of risking your own $1,000, you could be trading with $50,000 or even $200,000 of the firm’s money. Sounds amazing, right? Well, there’s a catch—you have to prove you can actually trade profitably before they let you touch their funds.

Why Is FTMO So Popular?

Out of all the prop firms out there, FTMO is probably the most well-known. Here’s why traders love it:

- Real Funding, Real Profits – FTMO lets traders access up to $400,000 in funding if they pass their challenge. Once funded, traders get to keep up to 90% of their profits.

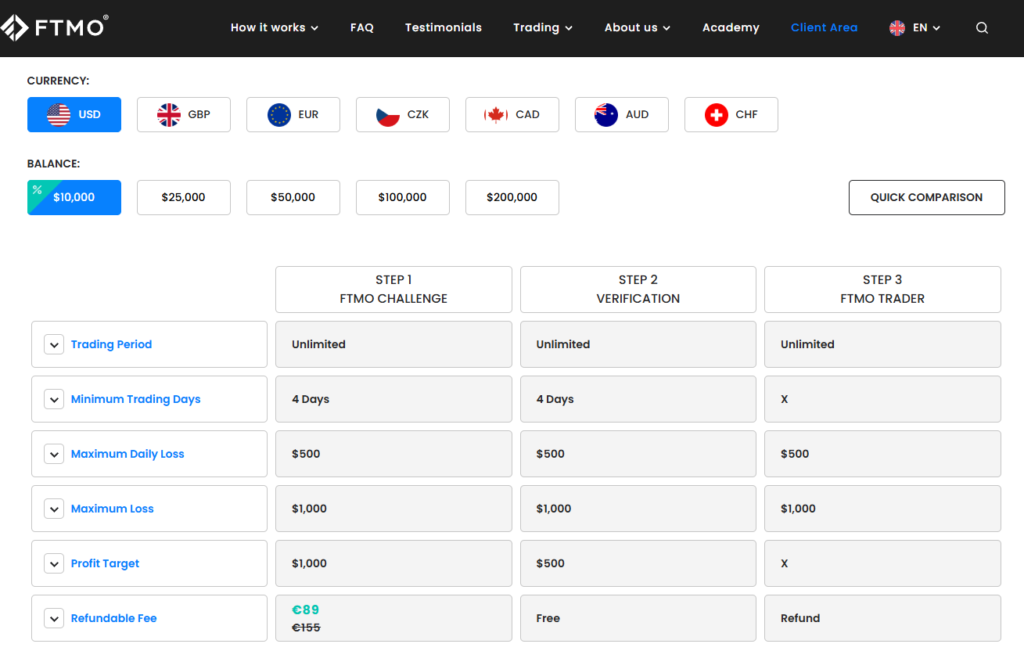

- Structured Evaluation Process – Unlike some shady firms that just take your fees and never pay out, FTMO has a clear challenge process. You must prove you can trade consistently before they hand you the money.

- No Personal Risk – You pay a one-time fee to take the challenge, but once funded, you’re not risking your own capital. You won’t wake up to a blown account and a zero balance.

- Legit Payouts – Many traders have successfully withdrawn significant profits from FTMO. Just check social media for their payout flex posts.

Prop Firms with Instant Funding

Not everyone wants to go through a challenge to prove themselves. If you prefer to get started right away, there are prop firms that offer instant funding. Some popular ones include:

- Tradeify – Provides instant funding for traders without requiring a challenge, allowing them to start trading with a funded account immediately.

- MyForexFunds Rapid – Offers an instant account option with a fixed profit split.

- The Funded Trader Express – A quicker alternative to the traditional challenge route.

- SurgeTrader – A firm that provides instant capital access but with strict risk rules.

- Apex Trader Funding – Popular among futures traders, frequently offering discounts (like 80% off sales) on their challenges.

- Bulenox – Another futures prop firm known for competitive pricing and flexible scaling options.

- Take Profit Trader – A newer firm gaining traction with straightforward funding and payout structures.

These firms can be great for traders who want to bypass the evaluation phase, but they usually come with higher fees or stricter rules.

The Benefits of Prop Firms

Trading with a prop firm has some serious perks, including:

- Leverage Without Debt – Instead of borrowing money and paying interest, you’re using firm capital. No debt, no stress.

- Higher Profit Potential – Instead of making $50 on a good trade, you could be making $500 or even $5,000 with a larger account.

- Risk Management Training – Most firms (including FTMO) require traders to manage risk properly. This forces you to develop discipline and consistency.

- Scalability – If you prove yourself, some firms increase your capital over time, meaning you can keep growing as a trader.

The Downsides of Prop Firms

While prop firms sound like a dream, they come with some challenges and restrictions:

- Strict Rules & Drawdown Limits – Many firms have strict risk management rules. If you exceed their daily or total drawdown limits, your account is gone.

- Profit Splits – Even though you’re trading with more money, you don’t get to keep 100% of your profits. Most firms take a cut, which can range from 10% to 50%.

- Challenge Fees – If you fail a challenge, you lose the fee you paid to take it. Some firms offer free retries, but others don’t.

- Withdrawal Restrictions – Some firms limit how often you can withdraw profits, which can be frustrating if you rely on trading income.

- Legitimacy Concerns – Not all prop firms are created equal. Some firms may have unclear payout structures or hidden rules that make it harder to succeed.

How You Can Make Money as a Day Trader with a Prop Firm

So, how do you actually turn this into income? Here’s the game plan:

- Pass the Challenge – FTMO and similar firms require you to complete a challenge with set profit targets and risk limits. Stay disciplined and don’t overtrade.

- Get Funded – Once you pass, you receive a funded account. This is where the real fun begins.

- Trade Smart – Focus on a solid strategy. Whether it’s price action, order flow, or indicators, consistency is key.

- Withdraw Profits – The goal is to withdraw profits regularly. A smart trader doesn’t aim for home runs but builds steady gains.

- Diversify & Scale Up – Many traders get funded by multiple prop firms to increase their capital and earnings.

Final Thoughts

Prop firms like FTMO are changing the game for traders who don’t have massive capital but have the skill. If you’ve ever wanted to trade with serious money but didn’t have the funds, this could be your way in. Just remember—it’s not a free ride. You still need discipline, strategy, and patience.

In the next topic, we will talk about what’s differences between Futures trading and CFD.

So, are you thinking of joining a prop firm? Or maybe you’ve already tried? Let me know in the comments—I’d love to hear your experiences!

FTMO is currently having a sale on their 10K accounts for 89 Euro. Get it here

Disclaimer : Promo price while it lasts